Crypto Fear and Greed Index: Understanding Market Psychology

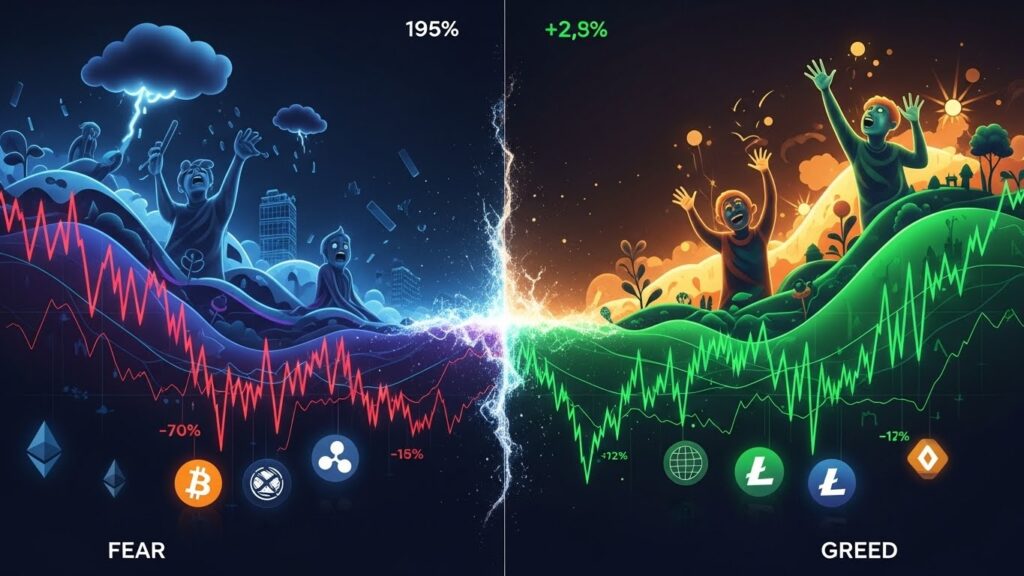

The crypto market is not driven only by charts and technology. Emotions play a huge role in price movement. One of the most trusted tools to measure investor emotions is the crypto fear and greed index.

In 2025, smart traders and long-term investors closely watch this index to understand whether the market is controlled by fear or dominated by greed.

What Is the Crypto Fear and Greed Index?

The crypto fear and greed index is a sentiment indicator that measures emotions in the crypto market.

It shows whether:

- Investors are scared (fear)

- Investors are overconfident (greed)

The index usually ranges from:

- Extreme Fear

- Fear

- Neutral

- Greed

- Extreme Greed

This helps investors understand market mood at a glance.

Why the Crypto Fear and Greed Index Matters

Markets often move based on emotion rather than logic.

The crypto fear and greed index helps investors:

- Avoid emotional decisions

- Identify buying opportunities

- Spot market tops and bottoms

- Understand crowd psychology

Many price reversals happen when emotions reach extremes.

How the Crypto Fear and Greed Index Works

The crypto fear and greed index is calculated using multiple factors, such as:

- Market volatility

- Trading volume

- Market momentum

- Social media sentiment

- Bitcoin dominance

These signals together reflect the emotional state of the market.

Crypto Fear and Greed Index and Buying Opportunities

One famous investment rule says:

“Buy when others are fearful, sell when others are greedy.”

When the crypto fear and greed index shows extreme fear:

- Prices are often undervalued

- Panic selling is high

- Long-term opportunities appear

Smart investors use fear zones to accumulate assets.

Crypto Fear and Greed Index and Market Tops

Extreme greed often signals danger.

When the crypto fear and greed index reaches extreme greed:

- Prices may be overheated

- Investors ignore risk

- Corrections often follow

This is when disciplined investors reduce exposure instead of chasing hype.

Crypto Fear and Greed Index vs Technical Analysis

Both tools serve different purposes.

| Tool | Purpose |

|---|---|

| Technical Analysis | Identifies price patterns |

| Crypto Fear and Greed Index | Measures market emotion |

Successful investors often combine technical analysis with the crypto fear and greed index for better decision-making.

Limitations of the Crypto Fear and Greed Index

While useful, the index is not perfect.

Limitations include:

- Short-term emotional bias

- Lag during fast market moves

- Overreaction in news events

The crypto fear and greed index should be used as a guide, not a standalone strategy.

How Beginners Should Use the Crypto Fear and Greed Index

Beginners can benefit by:

- Avoiding panic selling during fear

- Avoiding FOMO during greed

- Studying historical patterns

- Using it with basic research

Understanding emotions is as important as understanding technology.

Crypto Fear and Greed Index and Long-Term Investing

Long-term investors use the crypto fear and greed index to:

- Time better entries

- Control emotions

- Build positions gradually

- Stay patient during volatility

It helps investors remain calm in emotional markets.

Role of Media in Crypto Fear and Greed Index

News headlines strongly influence emotions.

Negative news increases fear, while hype increases greed. The crypto fear and greed index reflects how media sentiment shapes market behavior.

Understanding this relationship gives investors an advantage.

Future Importance of the Crypto Fear and Greed Index

As the crypto market matures:

- More data sources will be added

- Sentiment tools will become smarter

- AI may enhance emotional analysis

The crypto fear and greed index will remain a key psychological indicator.

Why the Crypto Fear and Greed Index Is Essential in 2025

With increasing volatility and global participation, emotional analysis is critical.

The crypto fear and greed index helps investors:

- Stay disciplined

- Avoid emotional traps

- Understand crowd behavior

It turns emotion into usable data.

✅ Conclusion: Crypto Fear and Greed Index Is a Powerful Market Tool

The crypto fear and greed index offers deep insight into market psychology. While it should not replace research or technical analysis, it provides valuable emotional context that most investors ignore.

Those who understand market emotions often outperform those who follow hype.