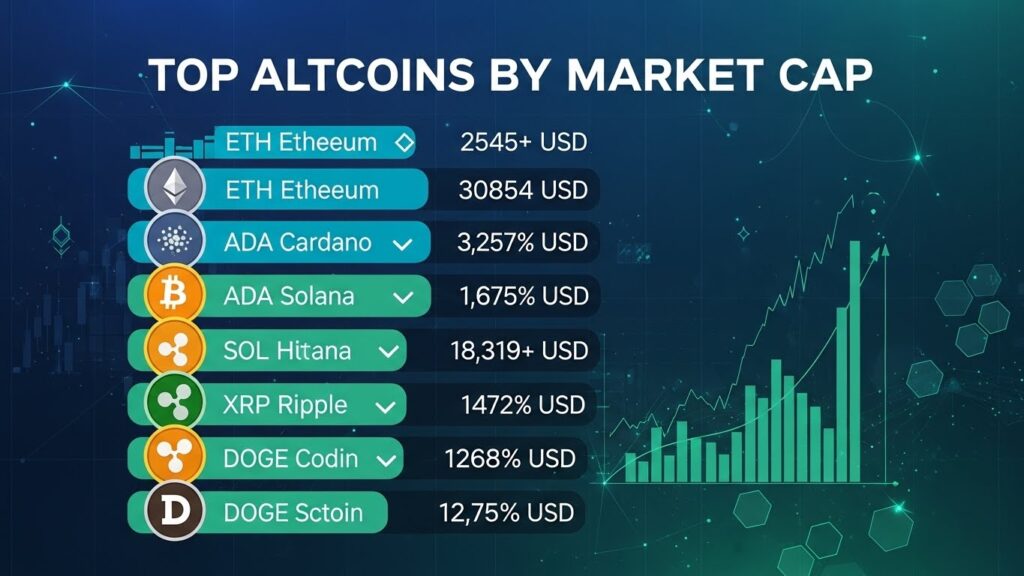

Top Altcoins by Market Cap: The Ultimate Guide for 2025

Tracking the top altcoins by market cap is crucial for anyone investing in the crypto market. Altcoins are digital assets other than Bitcoin, and their market performance often signals broader market trends.

In 2025, investors rely on real-time tools like CoinMarketCap and CoinGecko to analyze crypto prices, coin market cap, and bitcoin price charts, allowing them to make informed decisions.

What Are Altcoins and Why Market Cap Matters?

Altcoins include cryptocurrencies like Ethereum, Cardano, Solana, and others. Market cap represents the total value of a coin and is calculated as:

Market Cap = Current Price × Circulating Supply

The top altcoins by market cap indicate:

Investor confidence

Adoption level

Long-term viability

Higher market cap coins are generally safer but may offer slower growth than smaller altcoins.

How to Track Top Altcoins by Market Cap

Reliable tracking requires using real-time platforms:

Provides live crypto prices, rankings, and coin market cap data. It is widely trusted for accurate market metrics.

🔹 CoinGecko

Offers detailed analytics, historical data, and transparency metrics for altcoins, including performance relative to Bitcoin.

Using both platforms gives a complete picture of top altcoins by market cap.

Bitcoin Price Chart and Altcoin Performance

Bitcoin price charts significantly influence altcoins. Historically, altcoins rise when Bitcoin stabilizes or enters a bull phase. Tracking BTC trends helps predict potential altcoin rallies.

Stable or rising Bitcoin → Altcoins may gain

Declining Bitcoin → Altcoins often follow the trend downward

Understanding this correlation is key for strategic trading.

Factors Affecting Top Altcoins by Market Cap

Several factors impact top altcoins by market cap:

Crypto Price Trends – Daily fluctuations affect rankings.

Coin Supply & Scarcity – Circulating vs total supply matters.

Project Development – Roadmaps, upgrades, and partnerships.

Community Support – Engagement and adoption.

Market Sentiment – News, social trends, and macroeconomic conditions.

Analyzing these factors alongside coin market cap ensures informed investment decisions.

How to Use Crypto Price and Market Cap for Investment

Investors can combine crypto price trends with market cap analysis to:

Identify undervalued altcoins

Evaluate risk vs potential

Track growth over time

Decide allocation between BTC and altcoins

This forms the basis of a strong crypto portfolio strategy.

Tools for Monitoring Top Altcoins by Market Cap

Real-time trackers for daily crypto price updates

Bitcoin price charts to assess market trends

CoinMarketCap and CoinGecko for rankings and historical data

Portfolio apps for managing multiple altcoins

These tools simplify tracking the top altcoins by market cap effectively.

Risks in Investing in Top Altcoins

Despite high market caps, altcoins carry risks:

Price volatility

Regulatory changes

Network or project issues

Market manipulation

Balanced research and risk management are essential for sustainable returns.

Future Outlook of Top Altcoins by Market Cap

Experts predict the top altcoins by market cap will continue to diversify, with growth in DeFi, gaming, and Web3 projects. Tracking market trends, BTC influence, and reliable data sources like CoinMarketCap and CoinGecko will remain critical.

✅ Conclusion: Why Tracking Top Altcoins by Market Cap Matters

Monitoring the top altcoins by market cap is essential for both new and experienced investors. By using crypto prices, bitcoin price charts, coin market cap, and reliable platforms like CoinMarketCap and CoinGecko, you can make smarter decisions, minimize risk, and capture potential opportunities in 2025’s crypto market.